Within the age of prompt finance at our fingertips, mortgage apps have reshaped how we entry funds. However beneath the comfort lies a regarding pattern – malicious apps which might be being linked to tragic outcomes. On this weblog, we are going to make clear the alarming rise of those ‘death-traps,’ unravel the mechanics of those apps, and talk about options. We’ll additionally dive into Google Play’s new insurance policies and the Authorities’s measures in face of this risk.

Lure of the Mortgage App

A spate of tragic deaths have occurred within the final 2-3 years PAN India. The explanation – seemingly real mortgage purposes with sinister motives behind them. Victims comprise of these people who opted to take loans from such apps, however ended up committing suicide as a substitute, pushed by harassment, blackmail and abuse by operators of those mortgage apps.

Fig.1 Information articles about Mortgage utility victims

The modus operandi of those prompt mortgage apps is to supply small loans with out requiring a lot paperwork, however cost heavy rates of interest and sometimes resort to extortion by way of morphed pictures and cyber-bullying. These purposes are noticed to cost excessive rates of interest and have additional charges hidden throughout the settlement. Many of those apps. make the customers share pointless info together with contact particulars, pictures, location and extra. Subsequently, the operators behind these apps use these particulars to harass the sufferer by means of defamatory messages to their contacts with morphed pictures and so on. More often than not, the miscreants use inappropriate and provocative language to insult and demean the customers. This unwarranted harassment results in some customers going into melancholy and making an attempt suicide in worry of public humiliation.

As per Tech Crunch report in August 2022,

“Some are reportedly even taking their lives as a result of immense strain they get from these mortgage apps’ unregulated brokers. In line with native information stories, almost two dozen suicide circumstances owing to harassment coming from mortgage app operators have been reported on-line. Greater than half a dozen of them have been reported particularly from Hyderabad.”

Many customers of those purposes have reported their experiences and shared their considerations by commenting on Google Play Retailer. A few of these critiques learn,

“compensation time is lower than the sooner talked about, rates of interest are excessive, much less quantity disbursed in comparison with utilized mortgage, calling continuously for compensation, contacting kin or different contacts.”

Upon cautious remark of those critiques, they seem similar to feedback of victims’ whereas reporting of their loan-scam experiences.

Fig.2 Some critiques of reported purposes

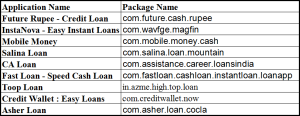

At Fast Heal Safety Labs, we repeatedly analyze purposes, particularly from Google Play Retailer. Our goal is just not solely to detect and establish malware, but additionally to report their authenticity to safe Android customers well timed. As of late, we have now reported 9 such mortgage purposes listed on Play Retailer to the Google Android group. These apps have been being utilized by risk actors to entice victims into providing simple loans, with unprecedented dire penalties.

Fig.3 Reported Mortgage purposes

Steps taken by Google

Google has been proactive in eradicating such purposes from their Play Retailer. In 2022, they reportedly eliminated greater than 3500 such mortgage purposes from Google Play Retailer. Following this, Google has additionally up to date its coverage relating to mortgage purposes infrequently.

In line with Google’s up to date mortgage utility coverage, it’s mandated that builders ought to: –

- Set the appliance class to ‘Finance.’

- Clearly point out the Minimal and Most interval of compensation.

- Clearly point out Most Annual Share Price which can embrace curiosity and different charges.

- Point out one instance of the entire value of the mortgage, together with the principal and all relevant charges

- Ought to give details about assortment, use and sharing of non-public and delicate information in privateness coverage.

Along with this, Google has additionally talked about that they don’t permit apps to advertise private loans which require compensation in full, in 60 days (about 2 months) or much less, from the date the mortgage is issued (“short-term private loans”)

In a current replace, Google has additional made main modifications in its coverage to deal with the difficulty of this mortgage death-trap. Private mortgage purposes are now not allowed to entry delicate information, comparable to pictures and contacts. To make sure that, Google has prohibited mortgage purposes to make use of following permissions to entry delicate private information: –

- Learn exterior storage

- Learn media pictures

- Learn contacts

- Entry high-quality location

- Learn telephone numbers

- Learn media movies

Steps Taken by the Authorities

Reserve Financial institution of India (RBI) has additionally printed Pointers on Digital Lending in September 2022. Within the guideline, RBI states that RE (Regulating Entities) ought to make sure that their DLA (Digital Lending Functions) mustn’t entry cell phone sources like media, contact checklist, name logs or telephony capabilities. Additional, it additionally states that solely one-time entry is allowed to digital camera, microphone and placement for KYC (Know Your Buyer) necessities. Right here, the RE consists of all of the Banks and NBFCs (Non-Banking Monetary Firm) who provide digital lending providers. DLA are private mortgage purposes which might be internet primarily based or utility primarily based.

In Feb 2023, the RBI requested the REs (Financial institution and NBFC) to share their purposes. The checklist was then shared with the Finance ministry. The Ministry has directed that each one purposes which aren’t on this checklist needs to be Blocked.

Evaluation of a Malicious Utility:

Utility title: Credit score Pockets: Simple Loans

Utility hyperlink: Credit score Pockets: Simple Loans – Apps on Google Play

MD5: fbc71d55961197df0e9e4aa7f388c073

Package deal title: com.creditwallet.now

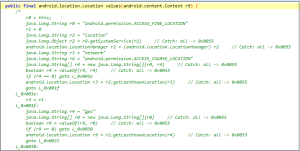

Fig. 4 reveals permissions declared by the appliance within the manifest file of Android APK. A few of these permissions are pointless like, android.permission.BLUETOOTH, android.permission.READ_CALL_LOG and so on.

Fig.4 Permissions declared by utility

As per the brand new Google Play Coverage, entry to contacts, exterior storage and placement is prohibited. Nonetheless, the appliance tries alternative ways to get entry to this delicate info as defined beneath:

1] Contact entry:

Unlawful Mortgage purposes ask for the sufferer’s contact numbers, title and images of the contacts and so on. This information is subsequently used to name or message kin and pals of the sufferer with the intention to intimidate the person and extort cash from them. Fig. 5 reveals the code utility used to get entry to contact particulars. It’s utilizing runtime permission to get contact entry: –

Fig. 5 contact entry

If it fails to get contact particulars through the use of the above technique, it makes use of one other choice to get the contacts checklist as illustrated in Fig. 6 beneath: –

Fig.6 Contact entry by uriMatcher

2] Exterior Storage entry:

By buying entry to exterior storage any utility will get entry to the person’s private pictures, movies, audios, paperwork and so on. This information is delicate and sometimes ignored by many customers. Exterior storage information is very misused by loan-scam operators. They take private pictures of victims; or their kin with the intention to morph them and blackmail the victims.

Fig. 7 reveals code utilized by this utility to entry exterior storage: –

Fig. 7 Accessing exterior storage

3] Location entry:

By monitoring places risk actors can get details about the locations visited, and conclusions could be made about person’s habits and preferences. It makes use of GPS information with community information to find out the situation. As per the brand new Google Play coverage, it’s prohibited for mortgage apps to declare ACCESS_FINE_LOCATION, which permits apps to get actual and correct geolocation.

Fig.8 reveals code utilized by the appliance to get location info: –

Fig. 8 Location entry code

The delicate PII (Personally Identifiable Data) collected by such apps is distributed to a command-and-control server within the type of a json file.

Fig. 9 code for info sharing

QuickHeal Safety Labs is ready to establish all such mal-intended purposes with numerous Android.Spyloan detections.

IOCs:

Tricks to keep protected:

- Attempt to keep away from downloading purposes from third get together shops. As a substitute, set up purposes from official shops solely.

- Whereas putting in the appliance from Google Play Retailer, pay shut consideration to the main points comparable to developer title, description, permissions being requested by the app, in addition to its person critiques.

- For mortgage purposes, test the NBFC (Non-Banking Monetary Firm) title talked about in description by way of a Google search of the title of the appliance, NBFC title and so on.

- Keep away from utilizing mortgage purposes from unknown banks, NBFCs and so on. and persist with recognized banking apps solely.

Conclusion

The current Google Play coverage stands as an important step in safeguarding customers from potential dangers posed by mortgage apps. By prohibiting sure permissions, the coverage addresses important privateness considerations. This transfer highlights the significance of steady vigilance and stringent rules to make sure the protection and safety of customers within the digital realm. The duty additionally lies on the a part of the digital person and loan-seeker. Staying knowledgeable and advocating for accountable app practices stays paramount on this evolving technological panorama.