As France continues its transition right into a digital-first financial system, companies should undertake environment friendly, safe, and various fee options to remain forward of the competitors. A fee gateway is a know-how that allows retailers to just accept on-line transactions by securely processing funds between prospects and monetary establishments.

Whether or not it’s accepting funds in conventional fiat currencies or increasing into the world of cryptocurrencies, selecting the best fee gateway could make all of the distinction in making certain seamless transactions and enterprise development.

| Transaction Price | Currencies Supported | |

| NOWPayments | 0.5 % | 300+ cryptos | 22+ fiat currencies |

| Paypal | 2.9 % | 0 cryptos | 26 fiat currencies |

| Stripe | 1.4 % | 1 crypto | 135 fiat currencies |

| Adyen | 2.7 % | 0 cryptos | 180 fiat currencies |

| 2Checkout | 3.5 % | 0 cryptos | 100 fiat currencies |

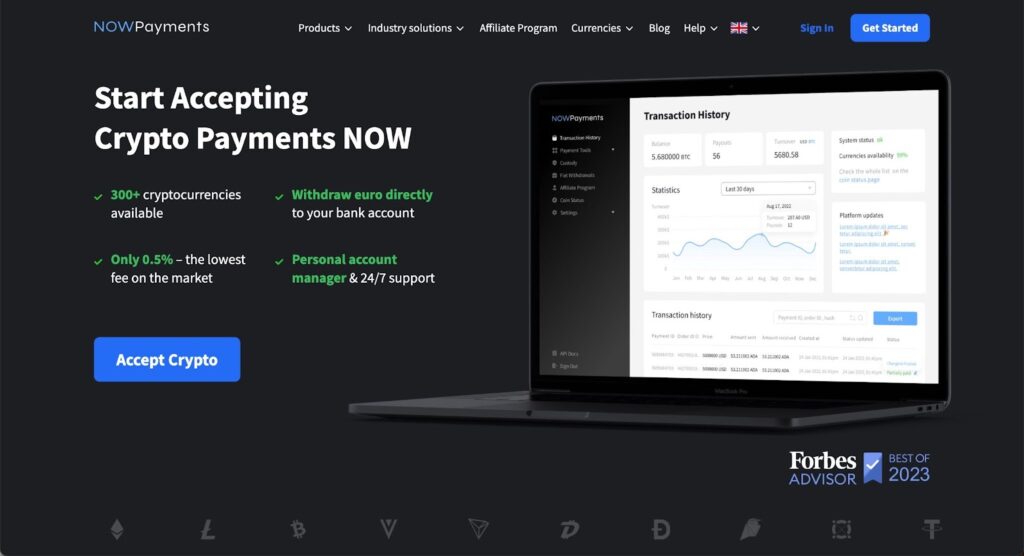

NOWPayments emerges as a top-tier fee gateway in France, providing seamless integration with a variety of fee choices, together with cryptocurrencies, bank cards, and digital wallets. With its user-friendly API, low transaction charges, and an expansive listing of supported cryptocurrencies, NOWPayments ensures that companies can effortlessly settle for funds from prospects in France and past.

From eCommerce platforms and fintech startups to iGaming and SaaS companies, NOWPayments empowers retailers with cutting-edge monetary options that improve the fee course of.

On this article we evaluation high fee gateways in France and why NOWPayments stands out as the most effective fee gateway in France and the way companies can profit from its progressive providers.

This sponsored put up was offered by NOWPayments. NOWPayments is a non-custodial service that enables everybody to just accept crypto funds on their web sites, on-line shops, and social media accounts.

NOWPayments as the most effective crypto fee gateway in France

Within the aggressive panorama of fee options, NOWPayments stands out as the most effective fee gateway in France. This fee service supplier permits retailers to just accept funds from French prospects via a wide range of fee strategies.

With its assist for each conventional credit score and debit card transactions and progressive different fee strategies, NOWPayments successfully meets the various fee preferences of shoppers in France.

Moreover, this fee gateway facilitates on-line fee processes by integrating seamlessly with digital wallets, permitting customers to handle their fee information securely. By providing a complete fee service that helps world funds, NOWPayments empowers companies in France to thrive within the French market.

For these selecting a fee gateway, NOWPayments is the dependable selection that enhances the fee course of and ensures that retailers can cater to the favored on-line fee strategies most popular by their clientele.

Web site: nowpayments.io

Based: 2019

Headquarters: Amsterdam, Netherlands

Nations Served: Worldwide

KYC: No

Assist: 24/7

Variety of Cryptocurrencies Supported: Settle for fee in crypto for numerous digital currencies. 300+

Annual Cost Quantity: The annual fee quantity contains transactions processed via our blockchain fee gateway. N/A

API: Sure, we settle for funds in a number of cryptocurrencies.

Crypto POS: Sure

Industries Served: They serve numerous industries which are keen to just accept fee in crypto. iGaming, Sports activities Betting, Fintech, eCommerce, Buying and selling, Grownup, SaaS, Streaming Platforms, Affiliate Networks, Charity, Journey, VPN and Internet hosting

Most important Providers: Their foremost providers concentrate on offering a dependable crypto fee processor. Most important providers embody a crypto gateway and superior pockets options. Stablecoin settlements, foreign money conversion, on/off ramps, multi-currency wallets for companies, wallet-as-a-service for white label options.

Regulatory Licences: Sure

API and SDK Documentation: NOWPayments affords complete API documentation with a number of SDKs (JavaScript, Python, PHP) for simple integration. Their API helps options equivalent to auto-crypto-to-fiat conversion, transaction monitoring, and customizable checkout choices.

Sandbox Surroundings: NOWPayments supplies a sandbox for testing, permitting builders to simulate funds and take a look at options with out processing actual transactions.

Plugin Assist: NOWPayments helps plugins for WooCommerce, Magento, OpenCart, and Shopify, making it adaptable for a variety of e-commerce platforms. The platform additionally permits for customized integrations by way of webhook assist for real-time transaction updates.

Pricing:

- Transaction Price: 0.5%

- Software Price: None

- Minimal Withdrawal Quantity: None specified

Why Select NOWPayments?

NOWPayments, established in 2019 and headquartered in Amsterdam, Netherlands, stands out as the most effective fee gateway in the marketplace attributable to its in depth options and flexibility. It serves purchasers worldwide, supporting over 300 cryptocurrencies—considerably greater than most rivals—which makes it ultimate for companies seeking to cater to a variety of crypto customers.

NOWPayments is a frontrunner when it comes to affordability and transparency, providing aggressive transaction charges beginning at simply 0.5% with a non-custodial mannequin, making certain companies retain full management over their funds. Its strong API and suite of plugins simplify integration with numerous e-commerce platforms, making it an environment friendly and scalable selection for companies of any measurement.

Mixed with 24/7 assist and a dedication to accessibility, NOWPayments actually represents the only option for companies seeking to combine cryptocurrency fee choices effectively and securely.

Seamless Integration with NOWPayments API for Builders

NOWPayments supplies a developer-friendly API designed for simple and environment friendly integration into numerous platforms. With a easy RESTful structure, builders can implement cryptocurrency funds with minimal effort whereas sustaining full flexibility of their fee flows.

The usual e-commerce integration features a simple order creation course of, permitting companies to generate invoices, observe fee statuses, and automate notifications by way of webhooks.

In contrast to many rivals, NOWPayments eliminates pointless complexity, making it a wonderful selection for initiatives that require a quick, dependable, and scalable crypto fee gateway.

One of many key benefits of NOWPayments’ API is its complete documentation and SDK assist. Builders can rapidly arrange their fee infrastructure utilizing well-documented endpoints and pattern requests. The API helps auto-conversion, enabling companies to just accept a variety of cryptocurrencies whereas receiving funds of their most popular digital asset.

Moreover, its non-custodial mannequin ensures that funds go on to the service provider’s pockets, enhancing safety and eliminating dangers related to third-party custody. This method considerably reduces the mixing time in comparison with legacy fee methods, permitting companies to concentrate on development slightly than operational overhead.

One other standout function is the versatile callback system, permitting real-time transaction monitoring. By leveraging webhooks, builders can arrange automated fee confirmations, enhancing buyer expertise and streamlining backend operations.

NOWPayments additionally supplies sandbox testing, enabling builders to simulate transactions earlier than going reside, lowering errors and making certain a easy deployment course of. With its low charges, quick integration, and in depth customization choices, NOWPayments affords a superior developer expertise in comparison with conventional fiat or crypto fee options.

PayPal fee gateway in France

PayPal is likely one of the most widely known fee gateways in France, providing a seamless manner for companies to just accept funds each domestically and internationally. It helps numerous fee strategies, together with credit score and debit playing cards, PayPal steadiness, and PayPal Credit score, offering flexibility for shoppers.

A key benefit of PayPal is its robust purchaser safety and fraud prevention measures, making it a trusted selection for on-line transactions. Nevertheless, its comparatively excessive transaction charges and occasional account freezes could be drawbacks for companies dealing with high-volume transactions.

Web site: paypal.com

Based: 1998

Headquarters: San Jose, California, USA

Nations Served: Worldwide

KYC: Sure

Assist: 24/7

Variety of Cryptocurrencies Supported: None (Primarily fiat transactions)

Annual Cost Quantity: $1.36 trillion (2023)

API: Sure, helps on-line funds, subscriptions, and invoicing

Crypto POS: No

Industries Served: eCommerce, Retail, Digital Items, SaaS, Subscriptions, Journey, Non-Earnings

Most important Providers: On-line fee processing, invoicing, PayPal checkout, PayPal credit score

Regulatory Licences: Sure

API and SDK Documentation: Intensive API and SDK assist for integration with on-line shops and fee platforms

Sandbox Surroundings: Sure, permits builders to check transactions

Plugin Assist: Appropriate with WooCommerce, Magento, Shopify, BigCommerce, and extra

Pricing:

- Transaction Price: 2.9% + fastened payment per transaction

- Software Price: None

- Minimal Withdrawal Quantity: None specified

Stripe fee gateway in France

Stripe is a developer-friendly fee gateway identified for its highly effective API and customizable options, making it a great selection for tech-savvy companies in France. It helps a variety of fee strategies, together with bank cards, Apple Pay, Google Pay, and SEPA Direct Debit, catering to various buyer preferences.

Stripe’s superior fraud detection system and seamless integration with subscription-based fashions make it significantly useful for SaaS companies and marketplaces. Nevertheless, its complexity might require technical experience to implement totally, making it extra fitted to corporations with growth assets.

Web site: stripe.com

Based: 2010

Headquarters: San Francisco, California, USA

Nations Served: 47+

KYC: Sure

Assist: 24/7

Variety of Cryptocurrencies Supported: Bitcoin (by way of third-party integrations)

Annual Cost Quantity: $1+ trillion (2023)

API: Sure, helps in depth fee choices and automation

Crypto POS: No

Industries Served: eCommerce, Fintech, SaaS, Marketplaces, Subscriptions, Enterprise Companies

Most important Providers: On-line fee gateway, invoicing, billing, Stripe Join for marketplaces, Stripe Terminal for in-person funds

Regulatory Licences: Sure

API and SDK Documentation: Complete developer documentation for fee integrations

Sandbox Surroundings: Sure, permits testing with out actual transactions

Plugin Assist: Helps WooCommerce, Magento, Shopify, OpenCart, and extra

Pricing:

- Transaction Price: 1.4% + €0.25 for European playing cards, 2.9% + €0.25 for non-European playing cards

- Software Price: None

- Minimal Withdrawal Quantity: None specified

Adyen fee gateway in France

Adyen is a worldwide fee platform that gives companies in France with an all-in-one answer for accepting funds throughout a number of channels. Identified for its robust presence in enterprise-level commerce, Adyen affords direct integrations with main banks, lowering intermediaries and transaction prices.

It helps an enormous array of fee strategies, together with native choices like Carte Bancaire, Klarna, and Bancontact, making it a most popular selection for companies focusing on European prospects. Adyen’s unified commerce method permits retailers to handle in-store and on-line funds seamlessly, although its pricing mannequin could also be extra appropriate for big companies slightly than small startups.

Web site: adyen.com

Based: 2006

Headquarters: Amsterdam, Netherlands

Nations Served: 50+

KYC: Sure

Assist: 24/7

Variety of Cryptocurrencies Supported: None (Primarily fiat transactions)

Annual Cost Quantity: €767.5 billion (2023)

API: Sure, helps fee processing, danger administration, and analytics

Crypto POS: No

Industries Served: eCommerce, Retail, Hospitality, Digital Items, Monetary Providers

Most important Providers: Multi-channel funds, fraud prevention, world fee acceptance

Regulatory Licences: Sure

API and SDK Documentation: Complete API for enterprise options

Sandbox Surroundings: Sure, permits for testing earlier than deployment

Plugin Assist: Obtainable for Magento, WooCommerce, Salesforce, Shopify, and extra

Pricing:

- Transaction Price: Varies by fee technique and nation

- Software Price: None

- Minimal Withdrawal Quantity: None specified

2Checkout fee gateway in France

2Checkout, now a part of Verifone, is tailor-made for companies seeking to promote internationally whereas making certain compliance with native laws. It helps a number of fee fashions, together with one-time purchases, subscriptions, and digital items gross sales, making it ultimate for eCommerce and SaaS corporations.

A significant advantage of 2Checkout is its built-in tax and compliance administration, which simplifies worldwide gross sales processes. Nevertheless, its increased transaction charges in comparison with some rivals could also be a consideration for cost-sensitive retailers.

Web site: 2checkout.com (now Verifone)

Based: 1999

Headquarters: Alpharetta, Georgia, USA

Nations Served: 200+

KYC: Sure

Assist: 24/7

Variety of Cryptocurrencies Supported: None (Primarily fiat transactions)

Annual Cost Quantity: N/A

API: Sure, helps world funds and recurring billing

Crypto POS: No

Industries Served: eCommerce, SaaS, Digital Providers, B2B, Subscriptions

Most important Providers: Cost gateway, subscription billing, world eCommerce options

Regulatory Licences: Sure

API and SDK Documentation: Intensive documentation for integrating with numerous platforms

Sandbox Surroundings: Sure, supplies a testing surroundings

Plugin Assist: WooCommerce, Magento, OpenCart, Shopify, PrestaShop, and extra

Pricing:

- Transaction Price: 3.5% + $0.35 per transaction

- Software Price: None

- Minimal Withdrawal Quantity: None specified

Conclusion Why NOWPayments is the most effective fee gateway in France

In a quickly evolving digital funds panorama, companies in France require a fee gateway that’s not solely versatile, safe, and cost-effective but additionally developer-friendly and simply scalable. Whereas conventional fee processors like PayPal, Stripe, and Adyen provide fiat-based options, NOWPayments takes innovation additional by offering seamless cryptocurrency fee assist, strong API integrations, and automation instruments designed for contemporary companies and builders alike.

NOWPayments’ API-first method ensures that builders can rapidly combine crypto funds with minimal friction, leveraging well-documented SDKs, webhook assist, and sandbox environments for testing. With assist for over 300 digital property, automated crypto-to-fiat conversions, and a non-custodial framework, companies keep full management over their funds whereas providing prospects a various vary of fee choices.

Whether or not you’re constructing an eCommerce platform, a fintech answer, or a Web3-based service, NOWPayments empowers builders with a easy but highly effective infrastructure to embed crypto transactions seamlessly.

By selecting NOWPayments, builders and companies in France can future-proof their fee ecosystems, cut back operational prices, and faucet into the quickly increasing world of decentralized finance. With its scalable, low-cost, and extremely customizable options, NOWPayments stands out as the best fee gateway for these seeking to innovate past conventional finance.