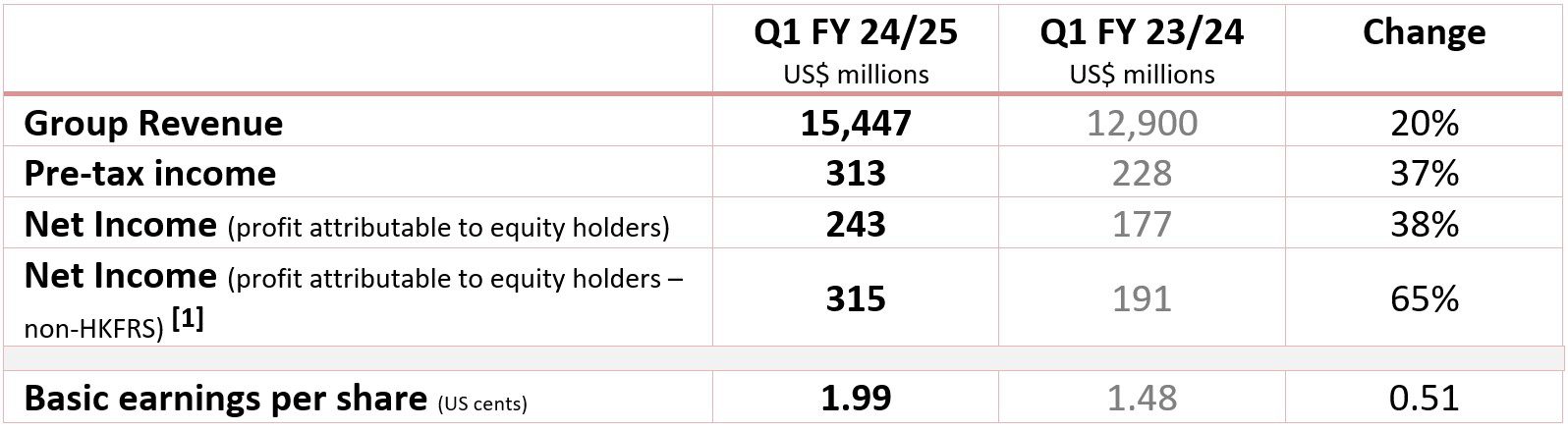

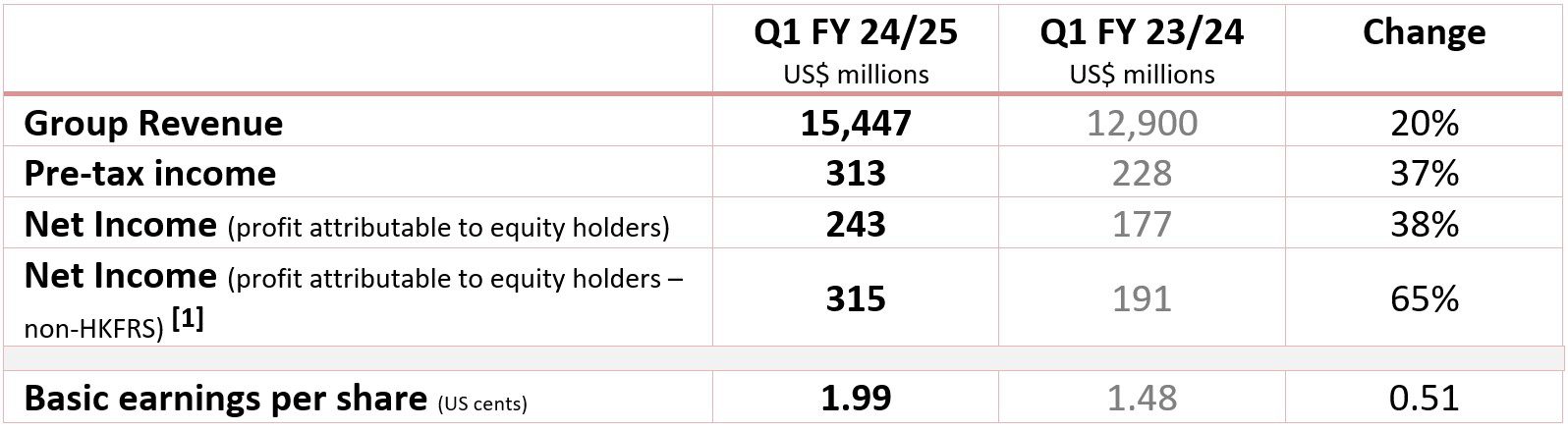

15 August, 2024 – Lenovo Group Restricted (HKSE: 992) (ADR: LNVGY), along with its subsidiaries (‘the Group’), right now introduced Q1 outcomes for fiscal 12 months 2024/25, reporting profitability enhancements throughout all areas of the enterprise and making vital progress in capturing hybrid AI alternatives. Group income elevated 20% year-on-year to US$15.4 billion, web earnings was up 65% year-on-year to US$315 million on a non-Hong Kong Monetary Reporting Requirements (non-HKFRS)[1] foundation, and non-PC income combine was up 5 factors year-to-year reaching a historic excessive of 47%. The Group’s outcomes replicate its clear technique and robust execution, persistent deal with innovation and operational excellence, in addition to the benefits it reaps from being a globalized enterprise.

The Group is each uniquely positioned and well-prepared to guide in an period of hybrid AI with its full-stack portfolio that includes AI gadgets like AI PCs, AI servers that assist all main architectures, in addition to wealthy AI native and AI embedded options and companies. Consumer suggestions from Lenovo’s AI PCs, outlined by 5 key traits, have been encouraging, with the primary AI PCs having launched in Could and lots of extra to return throughout IFA and Tech World later this 12 months. The Group is assured that it’ll lead the {industry} in market share for next-generation AI PCs, which total are anticipated to be greater than 50% of the PC panorama by 2027, in addition to lead in seizing the big development alternatives throughout the IT market. The Group continued its dedication to innovation, with R&D spending up 6% year-to-year to US$476 million.

Looking forward to development, in Could 2024 Lenovo introduced a strategic collaboration with Alat, a subsidiary of PIF, an funding within the type of convertible bonds from Alat, and a warrants issuance. These transactions will significantly profit the Group’s efforts to speed up its transformation via better monetary flexibility, seize the big enterprise development momentum within the Center East, and additional diversify and strengthen its provide chain footprint with a brand new manufacturing hub within the Center East. The transactions are topic to shareholder and regulatory approvals.

Chairman and CEO quote – Yuanqing Yang:

“The good begin to our fiscal 12 months has been pushed by our clear technique and robust execution, our persistent innovation and operational excellence, in addition to our globalization benefits. Trying forward, we’re each well-prepared and uniquely positioned available in the market with our full-stack AI portfolio to guide within the period of hybrid AI and seize the big development alternatives throughout our total enterprise. I’m assured that, with a recovering ICT market, the mixture of our stable efficiency and continued progress in hybrid AI will maintain enabling us to attain sustainable development and profitability will increase.”

Monetary Highlights:

Clever Gadgets Group (IDG): Double-digit income development with main profitability, successful in private AI

Q1 FY24/25 efficiency:

- IDG delivered a robust quarter of double-digit year-on-year income development with income of US$11.4 billion and virtually 1 level enchancment in working margin year-on-year.

- The PC enterprise retained in market management in each shipments and system activations, with 23% world market share and a premium to the market in development.

- Each the smartphone and pill companies delivered sturdy year-on-year income development of round 30%, with hypergrowth in premium smartphones.

Alternatives and Sustainable Progress:

- IDG is inspired by optimistic suggestions from the preliminary launch of its AI PCs for the China market, with additional world launches at IFA and Tech World later this 12 months.

- The PC market is coming into a brand new refresh cycle pushed by AI PCs, with this class anticipated to develop to signify over 50% of the overall PC market by 2027. The Group is assured it can lead the {industry} in market share for next-generation AI PCs.

- IDG will proceed to ship ground-breaking improvements throughout its portfolio to attain the total potential of a private AI agent, whereas on the identical time leveraging and deepening its strategic partnerships to construct a extra diversified portfolio and richer ecosystem.

Infrastructure Options Group (ISG): Hypergrowth with improved profitability, driving hybrid infrastructure

Q1 FY24/25 efficiency:

- Pushed by sturdy development in its Cloud Service Supplier enterprise, ISG delivered a file quarterly income of US$3.2 billion, up 65% year-on-year, and narrowed working losses each quarter-on-quarter and year-on-year.

- Mixed income from storage, software program and companies achieved vital development of 59% year-on-year, setting a brand new file.

- Income from ISG’s Neptune TM liquid cooled servers grew greater than 50%, pushed by its distinctive sustainability advantages amidst the {industry}’s rising AI workload wants.

Alternatives and Sustainable Progress:

- ISG is concentrated on driving the restoration of profitability by optimizing the enterprise mannequin for its enterprise and SMB enterprise, particularly simplifying portfolios and bettering operations.

- It is going to proceed to leverage the industry-leading liquid cooling expertise to fulfill rising AI workload calls for, in addition to the brand new development alternatives available in the market for AI servers and storage.

- As well as, ISG will proceed to develop key strategic partnerships and construct infrastructure platforms that assist hybrid AI options.

Options and Companies Group (SSG): Excessive margin with double-digit development, constructing enterprise AI

Q1 FY24/25 efficiency:

- SSG delivered its 13th consecutive quarter of double-digit year-on-year income development, with income of US$1.9 billion.

- Working margin in Q1 was over 20% – strengthening its place because the Group’s development engine and revenue contributor.

- Managed companies and mission and options companies income combine grew three factors year-on-year to account for 55% of SSG’s income.

Alternatives and Sustainable Progress:

- AI companies are anticipated to develop virtually twice as quick because the market generally to turn into the first driver of the IT companies market over the following few years.

- Lenovo will proceed to embed AI in its key choices, corresponding to Digital Office Options, Hybrid Cloud and Sustainability options.

- SSG will develop extra AI native companies to drive adoption and measurable ROI of AI for purchasers and speed up their transformation.

ESG and company highlights

Achievements, bulletins, and notable commitments over the previous quarter embrace:

- Lenovo has been ranked as one of many world’s greatest provide chains, rating tenth within the record of world corporations throughout all industries with probably the most distinctive provide chains on the planet within the Gartner Provide Chain High 25 for 2024. The famend annual rating evaluates throughout a number of standards together with monetary and company social duty information and group opinion.

- Lenovo has appointed Doug Fisher as Chief Safety and AI officer, increasing his current remit of safety to incorporate total AI governance together with championing the Group’s company AI coverage and dealing with its Accountable AI Committee.

- In July, Lenovo introduced the appointment of Dr. Tolga Kurtoglu because the group’s new Chief Know-how Officer, succeeding Dr. Yong Rui in additional accelerating the Group’s expertise imaginative and prescient and AI management. On the identical time, it additionally introduced the formation of a brand new Rising Know-how Group that’s charged with incubating and commercializing new applied sciences. The Rising Know-how Group is being led by Dr. Yong Rui.

[1] Non-HKFRS measure was adjusted by excluding web truthful worth adjustments on monetary property at truthful worth via revenue or loss, amortization of intangible property ensuing from mergers and acquisitions, mergers and acquisitions associated costs, achieve on deemed disposal of a subsidiary, impairment and write-off of intangible property; and the corresponding earnings tax results, if any.

About Lenovo

Lenovo is a US$57 billion income world expertise powerhouse, ranked #248 within the Fortune International 500, and serving thousands and thousands of shoppers day by day in 180 markets. Centered on a daring imaginative and prescient to ship Smarter Know-how for All, Lenovo has constructed on its success because the world’s largest PC firm with a full-stack portfolio of AI-enabled, AI-ready, and AI-optimized gadgets (PCs, workstations, smartphones, tablets), infrastructure (information heart, storage, edge, excessive efficiency computing and software program outlined infrastructure), software program, options, and companies. Lenovo’s continued funding in world-changing innovation is constructing a extra equitable, reliable, and smarter future for everybody, in all places. Lenovo is listed on the Hong Kong inventory alternate below Lenovo Group Restricted (HKSE: 992) (ADR: LNVGY). To seek out out extra go to https://www.lenovo.com, and browse in regards to the newest information by way of our StoryHub.