A brand new and fascinating sort of cyber theft is making rounds within the cyber world. This time the theft entails UPI (Unified Funds Interface) because the medium for tricking harmless victims into shedding their cash.

The growing recognition and ease of use of digital fee apps like Google Pay or Paytm have positively made life trouble free for folks of all ages. Making monetary transactions for all massive and small wants right this moment, is only a matter of click on.

However, as they are saying… Each coin has a flip facet to it.

Whereas these fee apps have made life simple for folks, they’ve additionally opened the gates for brand new sorts of frauds and scams. The current incidences of cyber theft utilizing UPI apps is a transparent indication of this reality.

It’s a frequent observe for banks to ship out SMS and calls, to warn folks to not share their checking account particulars or OTP with unknown folks. However, do you know that scamsters can now cheat you even with out these particulars??

Sure, that’s proper! So, how does this UPI fraud work?

- Effectively, the fraud begins with you itemizing a product on websites like OLX or Quikr and a few fraudster responding to it, pretending to be interested by shopping for the product. The story is straight away backed by the unavailability of cash-payment choice and as a substitute suggesting a fee app like PhonePe or Google Pay app for making fee.

- Assuming this to be a real cause, you agree to simply accept the fee by way of PhonePe. Your confidence within the particular person turns into stronger whenever you see the profile pic to be that of an Military man (which really is a pretend profile pic).

- As soon as the fraudster has your confidence, you’re despatched a collect-call request for the precise quantity that you’ve listed for the product. You’re in a rush to obtain your cash and easily ignore what the fraudster is definitely requesting. Apparently, as quickly as you obtain the request, the fraudster calls asking you to rapidly enter your UPI pin and hit the ‘Pay’ button to obtain cash instantly.

That’s the catch!!

What you fail to spot is that you’ve your self entered your UPI pin and supplied approval for the fraudster to dupe you out of your cash.

Specialists consider the foremost cause for such scams to emerge and thrive, is the ignorance or half information that a number of customers have relating to digital funds & transactions. Most of those customers fall underneath the old-age, first-time-user or housewives class, who turn out to be simple unsuspicious victims of such frauds and scams out of ignorance.

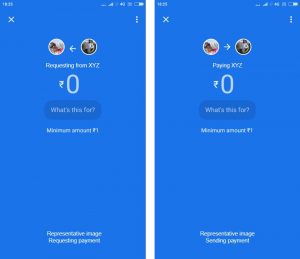

In wake of the rising incidence of UPI frauds previously couple of months, many fee apps like Google Pay have modified their consumer interface, to explicitly present the circulation of cash and make it simple for customers to differentiate if they’re receiving or sending cash. Additionally they elevate an alert in case a “gather request” is acquired from somebody exterior the consumer’s contact record or too many requests are raised.

Effectively, with the variety of UPI transactions growing at a gradual charge, this can be very essential that customers additionally turn out to be conscious of fraudulent on-line transactions and preserve their eyes open for issues that will point out fraud.

- To start with, fastidiously examine and recheck each message, popup or request that you just obtain in your fee app whereas coping with a transaction.

- Test the course of arrow to substantiate whether or not you’re sending or receiving cash.

- DO NOT blindly belief profiles of strangers simply because their profile info and film look actual.

- DO NOT share or enter your UPI PIN with anyone. Keep in mind that UPI PIN isn’t required to obtain cash. It is just wanted when sending cash to different UPI account.

- Be completely positive earlier than hitting the Pay or approve button on any fee app.

- Most significantly, preserve a frequent examine in your checking account assertion for any suspicious transaction.

Whereas the following tips and tips can shield you from changing into a sufferer of UPI fraud, one of the best ways to safe your cellphone whereas making on-line transactions is to put in a cellular safety app.

Fast Heal Whole Safety App comes with SafePe function that’s particularly designed to safe your monetary info, when utilizing cellular fee apps for on-line buying, banking, paying payments, and so forth. Listed here are few protecting options SafePe provides you:

- Checks whether or not the cell phone is related to an un-secure public Wi-Fi community and warns the consumer.

- Checks if the OS of the cell phone is tampered with, and warns the consumer about it.

- Checks if the cellular gadget is rooted.