We’ve all heard about cryptocurrencies like blockchain or Bitcoin. What’s much less well-known is how this market works, why folks put money into it, how they earn cash, and what errors can result in immediate smash. Our three posts on blockchain and cryptocurrencies, NFTs, and the metaverse cowl the crypto fundamentals. Right this moment, we take a dive into a subject made scorching by Donald Trump’s victory within the U.S. presidential election: different cryptocurrencies equivalent to meme cash.

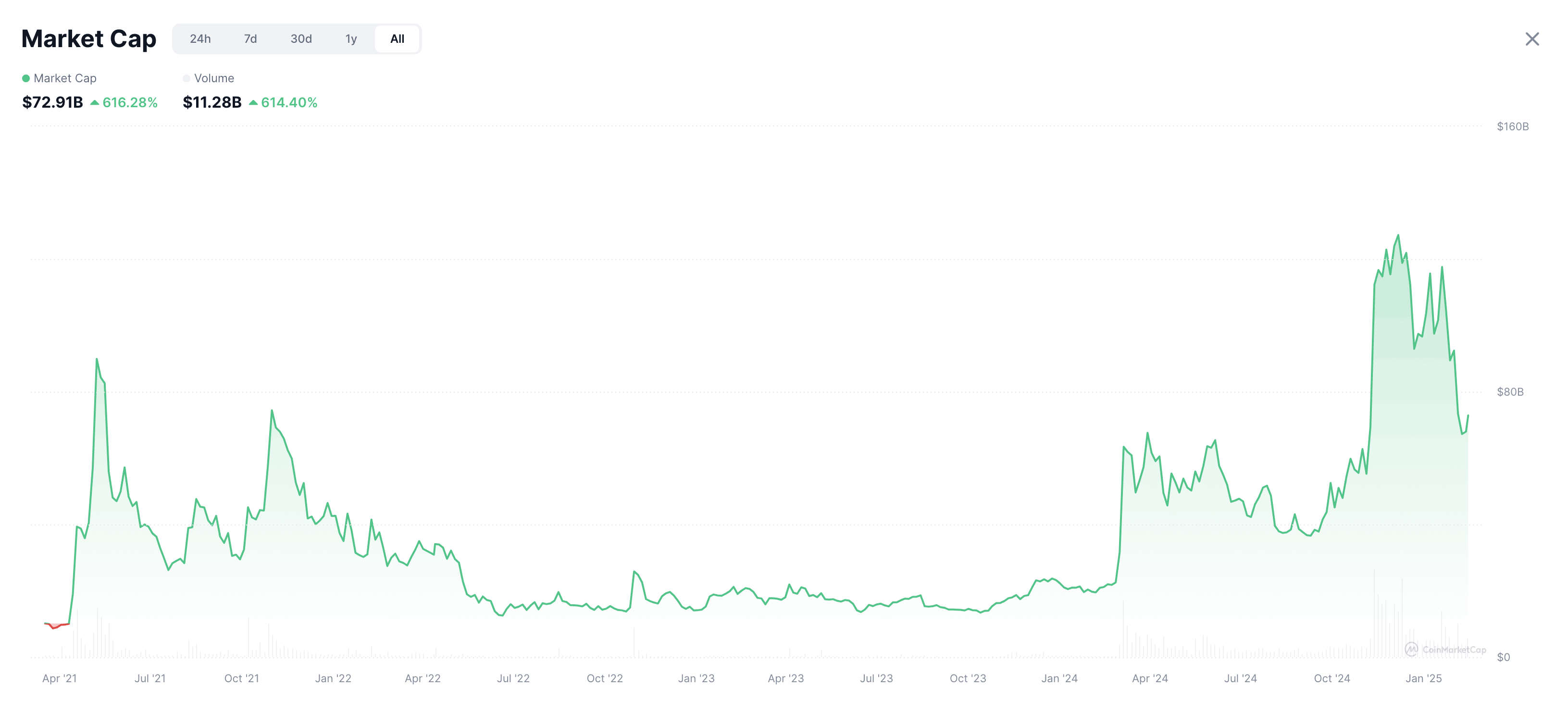

For these with little time to spare, right here’s the TL;DR: Since 2021, the market capitalization of meme cash has fluctuated wildly between $8 billion and $103 billion, with towering ups and crashing downs. The possibilities of dropping cash vastly outweigh these of constructing it, and the variety of scams is excessive even by crypto market requirements. So the ethical is: don’t make investments cash that you would be able to’t afford to lose — even into one thing that bears the title of the present U.S. President.

For these with slightly extra time on their arms, let’s check out some joke cryptocurrencies, discover what — if something — they’ve in widespread with NFTs, and let you know what precautions to take when you’re decided to speculate on this high-risk market.

Take a look at how meme-coin market capitalization has modified over the previous few years. Supply

Meme cash and altcoins — what are they?

Technically, meme cash (aka meme tokens, meme cryptocurrencies) are a kind of altcoin; that’s — different cryptocurrencies. “Different” purely within the sense of not being the biggest and most widespread of cryptoassets: Bitcoin and Ethereum. Traditionally, altcoins tended to be launched as impartial blockchain platforms, however at present they’re extra prone to piggyback an current widespread blockchain platform, equivalent to Solana.

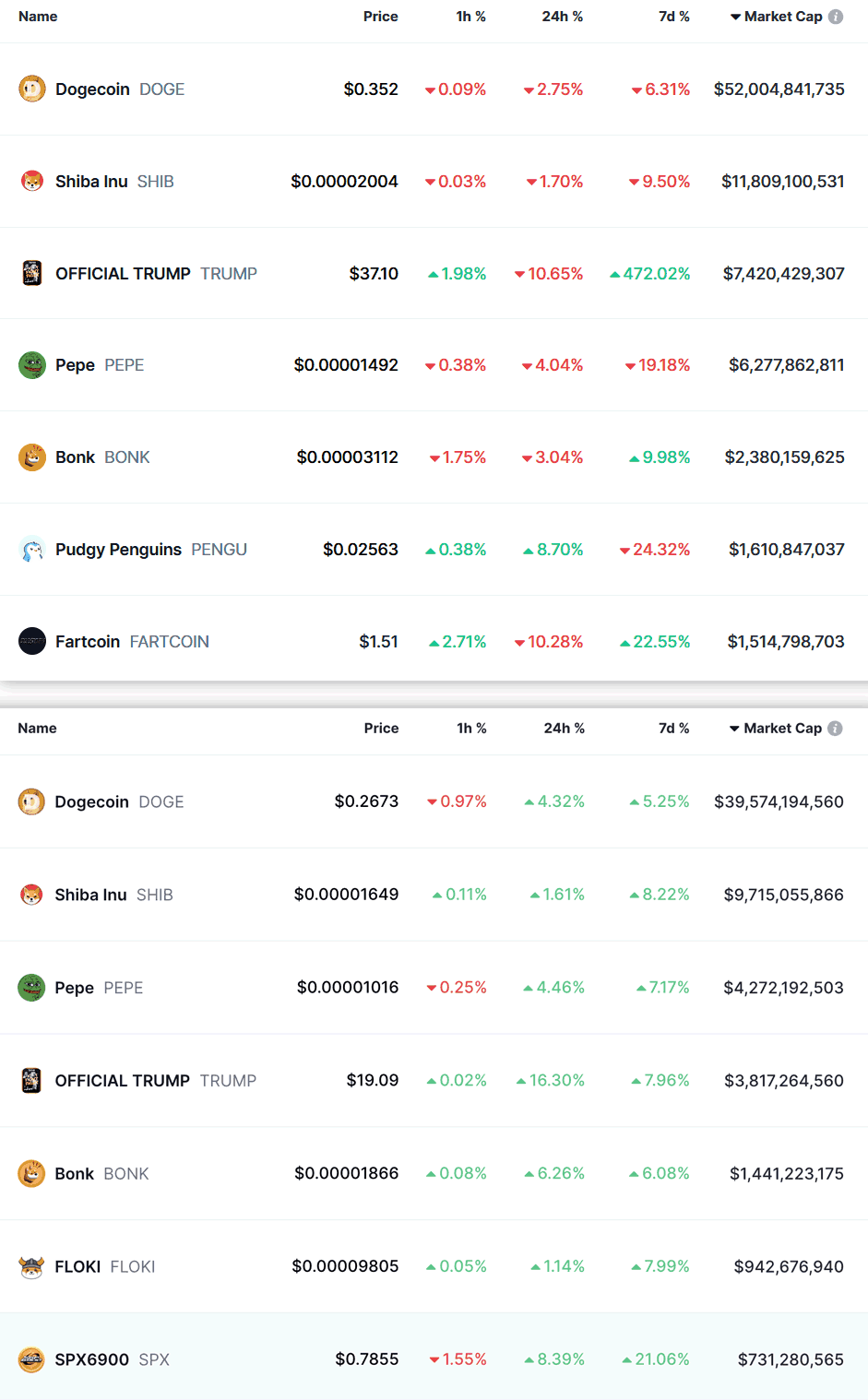

To get a way of the volatility of the meme coin market, examine the value and capitalization of sure randomly-chosen tokens in three weeks from late January (prime) to mid-February (backside), 2025. Supply

Of their issuance and circulation mechanisms, most altcoins supply holders some tangible advantages — from low charges and excessive transaction speeds to pegging to real-world belongings. Nonetheless, meme cash, of which Dogecoin was the primary, have been initially issued as a joke, and an opportunity to put money into a fleeting social pattern — to indicate one’s love for a meme, or help for an actor, public determine, or media character. Though a meme coin is a cryptocurrency, its worth is decided primarily by how enthusiastic individuals are to put money into it. Because of this, these crypto belongings are liable to sharp value spikes, relying on who wrote what on social media, whether or not folks preferred an actor’s new film, and different such components.

Meme cash and NFTs — similarities and variations

Each meme cash and NFTs use blockchain know-how to retailer possession information and transaction historical past. However not like cryptocurrencies — the place any two cash are equal and interchangeable, identical to a few hundred-dollar payments, every particular person NFT is exclusive, and therefore the title: non-fungible tokens. Every token secures possession of some distinctive digital asset — imparting collector worth to NFTs.

And since collector worth is basically subjective, NFTs, like meme cash, are extremely prone to hype, hypothesis, and wild value swings.

Prime meme cash

This part will age quick, however on the time of posting, the largest meme cash by market capitalization are Dogecoin (ticker image: DOGE), Shiba Inu (SHIB), Pepe (PEPE), OFFICIAL TRUMP (TRUMP), and Bonk (BONK) — with the primary exceeding $39 billion, and the final slightly below $1.5 billion. The TRUMP meme coin was nowhere within the neighborhood of this prime checklist a month in the past — additional proof of simply how fickle this market is.

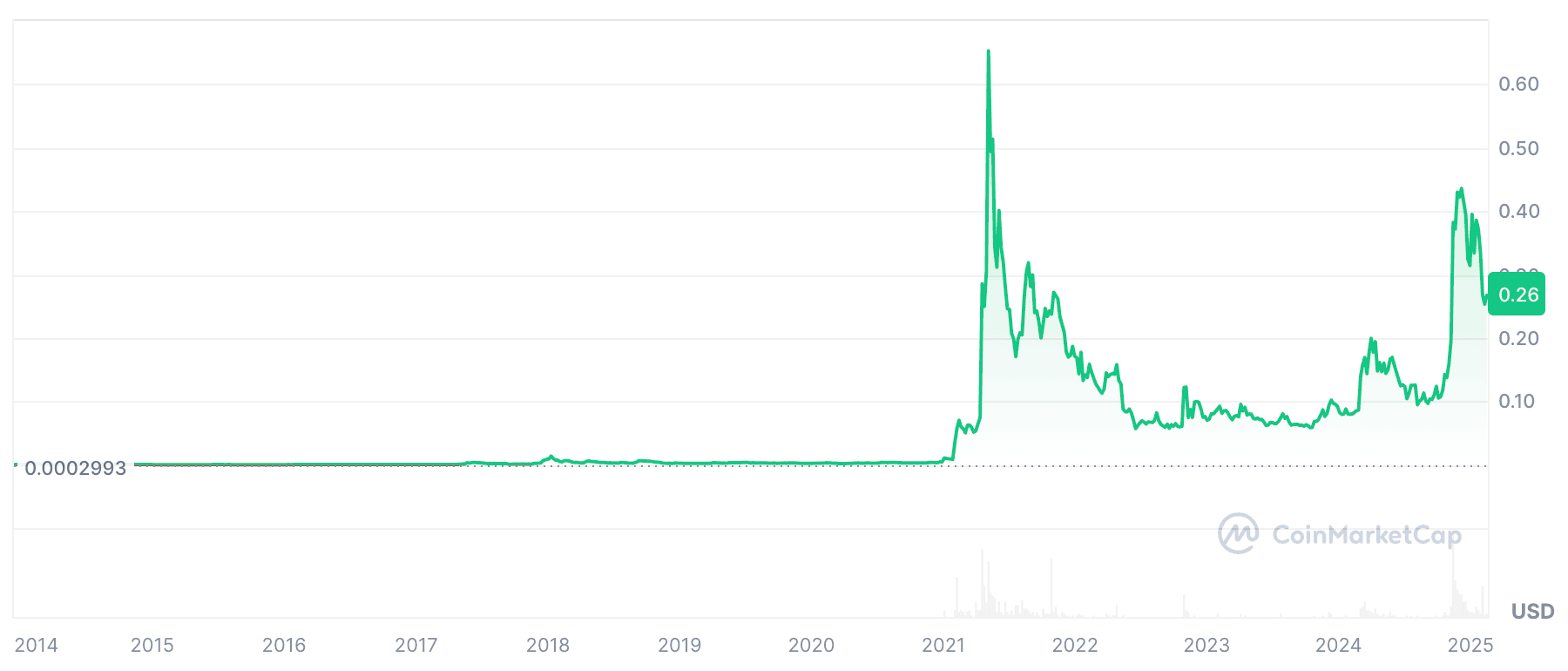

The pack chief, Dogecoin, nonetheless, is an actual survivor. Greater than a decade previous, its worth hovered between $0.0001 and $0.0002 for the primary two years, and infrequently nudged previous $0.01 within the following 4. Nonetheless, after being endorsed by Elon Musk in 2021, it briefly soared to $0.63, earlier than sinking to round $0.06. It spiked once more final November to over $0.4 after the presidential victory of the crypto-supporting Trump — over whom Musk seems to have some affect.

Worth dynamics of the oldest meme coin, Dogecoin (DOGE). Supply

TRUMP, MELANIA, and BARRON

The brand new U.S. President’s household deserves a separate chapter in our story as a result of it completely illustrates the important properties of meme cash.

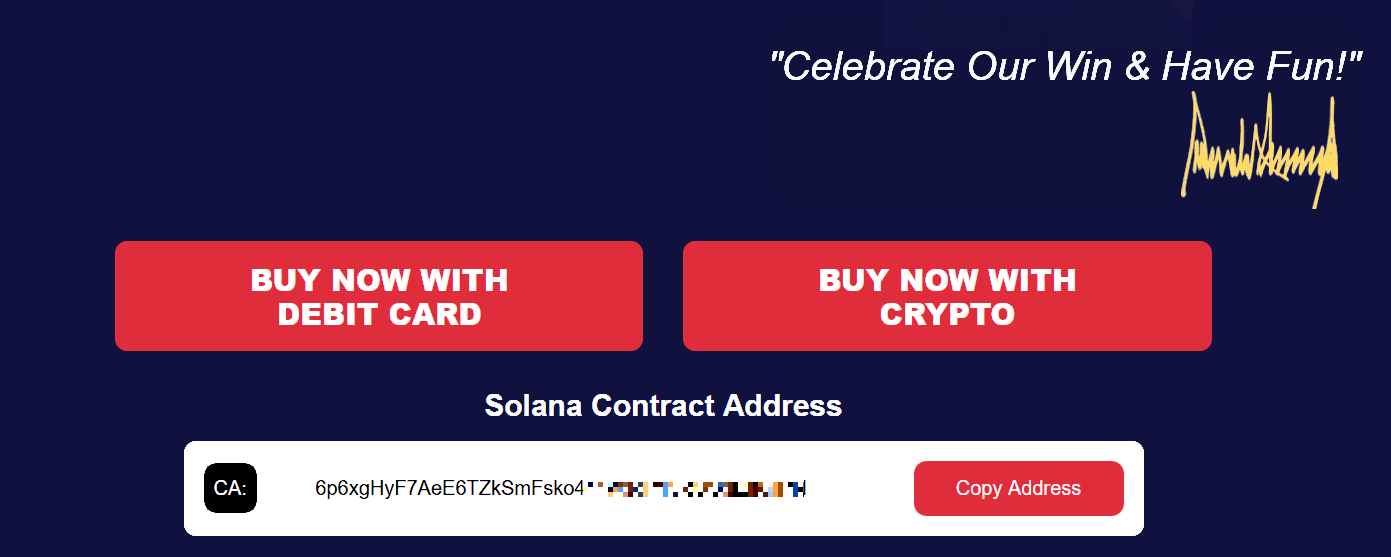

Simply three days earlier than taking workplace in 2025, Trump introduced the launch of his eponymous meme coin, which climbed to $75 in simply two days, then halved, and has been steadily falling over the previous three weeks — dropping to round $19 on the time of posting. Technically, TRUMP is issued on the Solana blockchain, with a complete “mintage” of 1 billion cash. Nonetheless, solely 200 million have been launched into circulation, whereas the remainder remained below the management of CIC Digital LLC and Battle Battle Battle LLC — each affiliated with the Trump Group.

Worth dynamics of the OFFICIAL TRUMP meme coin (TRUMP). Supply

With the problem structured on this manner, the Trump Group can dictate each costs and demand, because it controls considerably extra cash than are on the open market. It might probably generate income by promoting cash at excessive costs — each saturating the market and driving costs down. Or it could possibly select to not promote, and as a substitute look forward to an uptick in market sentiment to maximise earnings. Worth dilution attributable to elevated provide primarily hits those that purchased the cash at peak worth and hype — favoring each patrons who obtained the cash cheaply, and people who issued the coin in query.

This strategy has drawn criticism from many within the crypto trade, equivalent to Nick Tomaino: “Trump proudly owning 80% and timing launch hours earlier than inauguration is predatory and plenty of will seemingly get damage by it”.

Blockchain evaluation agency Chainalysis confirmed that within the first few days after the launch, nearly 80% of the 600,000 patrons earned lower than $100 on the token, and barely recouped their funding. Tellingly, 50% of TRUMP patrons have been crypto first-timers who had solely created a pockets and plunged into the market particularly for this deal.

Just a few weeks later, nearly all TRUMP buyers have been out of pocket. On the identical time, a choose group of 21 “whales” (patrons of 500,000+ tokens) made over $214 million within the first days of the meme coin’s circulation.

In all equity, the web site distributing the cash does state that purchasing them represents “an expression of help for, and engagement with, the beliefs and beliefs embodied by the image $TRUMP”, and isn’t to be seen as an funding.

Two days after the TRUMP announcement, the First Girl adopted swimsuit with the launch of her personal meme coin. Having briefly risen above $12, only a day later MELANIA took a downward flip and spent a few days on the $3-5 vary, earlier than stabilizing at round $1.4. Simply because the MELANIA launch information broke, TRUMP plummeted.

Naturally, all this hullabaloo over “political” meme cash might hardly escape the eye of scammers. Blockchain platforms witnessed a mushrooming of tokens with TRUMP because the ticker image or within the description — regardless of having nothing to do with the “official” meme coin.

Probably the most eye-catching was the meme coin within the title of the U.S. president’s youngest son, Barron Trump. Aided by a profile on the Pump.enjoyable web site (the place anybody can rapidly launch their very own meme coin) plus a handful of X posts pretending to be associated to an investigation and leaked insider info, in only a few hours the unofficial meme token scored a market capitalization of $460 million. Nonetheless, when proof of “presidential” origin did not materialize, the token crashed by 95%.

Main meme coin and NFT scams

Rug pull (exit rip-off).

The commonest rip-off related to newly-issued crypto belongings. Scammers mislead patrons concerning the origins of a specific coin or NFT venture and the worth of the tokens, promote a bunch of them, and vanish. The bought tokens stay with the brand new house owners however quickly depreciate. Within the case of meme cash, this scheme is commonly carried out with a star allegedly issuing their very own token, which later seems to be a hoax. Within the case of NFTs, patrons are promised non-existent privileges or collector worth. An notorious case was the Baller Ape Membership NFT, which led to one of many first indictments for NFT fraud. In accordance with Chainalysis, nearly one in 20 tokens issued in 2024 could have been rug pulls; whereas in 2021, these scams introduced crypto buyers a complete lack of $2.8 billion.

“Namesake” assault. For simple identification on crypto exchanges and different crypto platforms, every token is assigned a novel code referred to as a ticker — identical to on conventional exchanges: BTC, USDT, TRUMP, and so forth. However in actuality, the shopping for and promoting of tokens relies not on tickers, however on lengthy, hard-to-read good contract addresses. A standard assault exploits this duality. Scammers create their very own tokens (altcoins) with a unique contract handle within the blockchain — however below the identical ticker as a preferred token, for instance, TRUMP. Typically the scheme may even work when the ticker is completely different, and the big-draw title merely seems within the coin description. Such tokens are sometimes launched on a unique blockchain the place the unique coin isn’t traded. All these eventualities boil all the way down to the identical factor: the sufferer buys a very completely different crypto asset, which seemingly has no worth.

The web site promoting real TRUMP tokens states the related good contract handle explicitly. Nonetheless, scammers can create a duplicate of the web site and publish a unique good contract handle

Honeypot tokens. These are tokens whose good contract doesn’t enable their sale. In different phrases, you possibly can make investments cash in them, however not withdraw it. This rip-off is commonly mixed with the “namesake” assault.

Drainers. Our separate publish covers this risk intimately. Pondering they’re shopping for meme cash or NFTs, victims enter their credentials on a faux web site and have their crypto wallets emptied. The bait web site both mimics the official one, or provides a faux promotion equivalent to a token airdrop.

Phishing and malware. Underneath the guise of social media posts by celebrities, messages from technical help, and numerous different pretexts, attackers swindle personal keys and seed phrases from crypto holders, in addition to set up malware on their computer systems and telephones to siphon off crypto-related info. The result is at all times the identical: the lack of all funds within the crypto pockets.

There are different, extra unique methods of stealing cryptocurrency: hacking previous Bitcoin wallets by encryption algorithm bugs, faux {hardware} crypto wallets, and contaminated video games like Mario Endlessly or tanks.

There are even Robin Hood scams focusing on crypto thieves themselves. A juicy bait is dangled earlier than their eyes — for instance, “leaked” credentials of wallets supposedly containing a whole lot of 1000’s of {dollars} or seed phrases for actual crypto wallets — however after paying a “charge” to withdraw the funds, they uncover {that a} withdrawal isn’t attainable.

Our weblog is residence to dozens of different gripping detective tales about crypto scams. Sadly, the checklist is increasing every day, so subscribe now to maintain updated with all the most recent threats.

How to not lose cash on crypto, NFTs, and meme cash

- Don’t put money into crypto belongings in case you have any doubts about your monetary scenario or the steadiness of world markets, or don’t really feel sufficiently certified.

- Don’t put money into crypto belongings (or anything) what you possibly can’t afford to lose.

- Should you want crypto belongings for cost functions, use cash with low volatility, equivalent to USDT stablecoins, and don’t purchase extra crypto than it’s essential to settle the account.

- Should you’re investing in crypto belongings for revenue, be ready to intently monitor the market dynamics and react rapidly. This can be a every day job, all of the extra so for meme cash — it’s essential to observe social media traits and strike when the market is scorching. Cryptocurrency hypothesis (on meme cash specifically) could be very robust in Asia, so you could have to regulate your “buying and selling day” to the Far Japanese time zone.

- Give desire to initiatives and tokens which were in the marketplace for some time and earned a sure status.

- If shopping for a newly launched token, make sure that it isn’t a rug pull or Ponzi scheme. It will require researching the status of the venture creators and the token’s technical options. If the venture’s good contracts have been audited, research the outcomes. The shortage of such an audit isn’t a crimson flag per se, however it ought to put you in your guard. If it’s a meme coin linked to a star, have a look at their official social media accounts and profiles, and ensure they have been truly concerned.

- Purchase tokens on giant platforms which have inside requirements and adjust to authorized rules. Examples embrace Binance and Coinbase. When getting details about a token, particularly its good contract handle, be sure to go to the official website and never a faux. Don’t enter crypto pockets credentials, card particulars, or different delicate info on third-party websites.

- Fastidiously verify good contract and crypto pockets addresses to keep away from shopping for a “namesake”.

- Watch out when trying to find crypto-related websites, information, and social media accounts, and be cautious of messages despatched to you in electronic mail and messaging apps. Crypto buyers are frequent targets of phishing and pig butchering

- Set up complete safety options on all of your units to guard towards malware and web sites designed to steal crypto belongings. We suggest Kaspersky Premium, which provides further privateness safety and data-leak monitoring instruments, plus the built-in on-line cost safety system Secure Cash.

The knowledge on this article is for informational functions solely and doesn’t represent funding recommendation. The devices mentioned could not match your funding profile, monetary scenario, funding expertise, or funding objectives.