The official Twitter account of the US Securities and Trade Fee (SEC) was hacked yesterday, with scammers posting an unauthorised message to its 660,000+ followers.

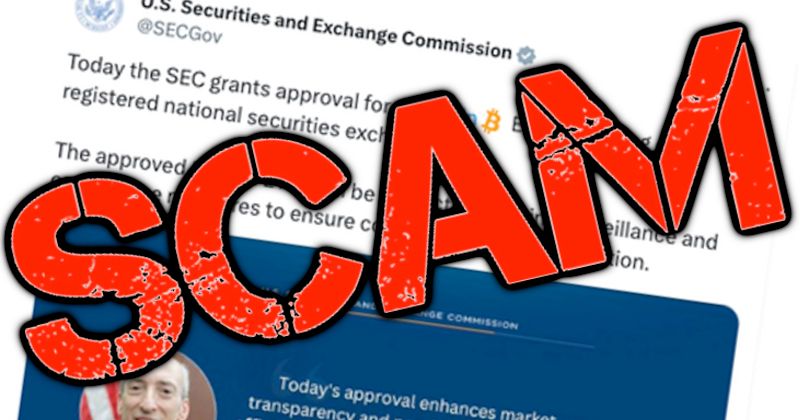

The false message – which has since been deleted – claimed that the SEC had authorized the itemizing and buying and selling of spot bitcoin ETFs, and triggered the market value of Bitcoin to instantly bounce to just about US $48,000.

The tweet was accompanied by a picture quoting SEC chairman Gary Gensler concerning the “approval”. Frankly, there wasn’t a lot concerning the tweet which might have raised suspicion amongst the everyday Twitter consumer – even those that would think about themselves extra security-savvy.

So as to add an extra twist to the story, for weeks merchants have been speculating that the SEC will approve exchange-traded funds that monitor the worth of Bitcoin this week – maybe even as we speak.

Nevertheless, posting from his personal Twitter account, Gensler confirmed that the information was false, no choice had been introduced, and the SEC’s official account had been hacked.

“The @SECGov Twitter account was compromised, and an unauthorized tweet was posted,” wrote Genseler. “The SEC has not authorized the itemizing and buying and selling of spot bitcoin exchange-traded merchandise.”

As soon as it had regained management of its account, which occurred with notable velocity in comparison with typical Twitter account breaches, the SEC confirmed on its official account that it had been compromised, utilizing the identical wording as its chairman.

As the reality emerged, the worth of Bitcoin slipped again down once more, doubtlessly inflicting some buyers to have suffered monetary losses.

Ever opportunistic, at the least one scammer created a pretend SEC account on Twitter the place they revealed an apology for the incident, and invited anybody who had misplaced cash as a consequence of the hack to go to a refund website – which was, in fact, itself a rip-off.

If another organisation had posted a message which had triggered the monetary markets to maneuver up and down so dramatically, they might be anticipated to be investigated for market manipulation.

Who would do such an investigation into market manipulation? Properly, that may be the job of the SEC itself.

The irony is not misplaced on anybody, as we wait and see if the SEC publicizes that it will likely be investigating itself over the incident…

US politicians and legal professionals are already demanding that there’s a thorough investigation into what went improper.