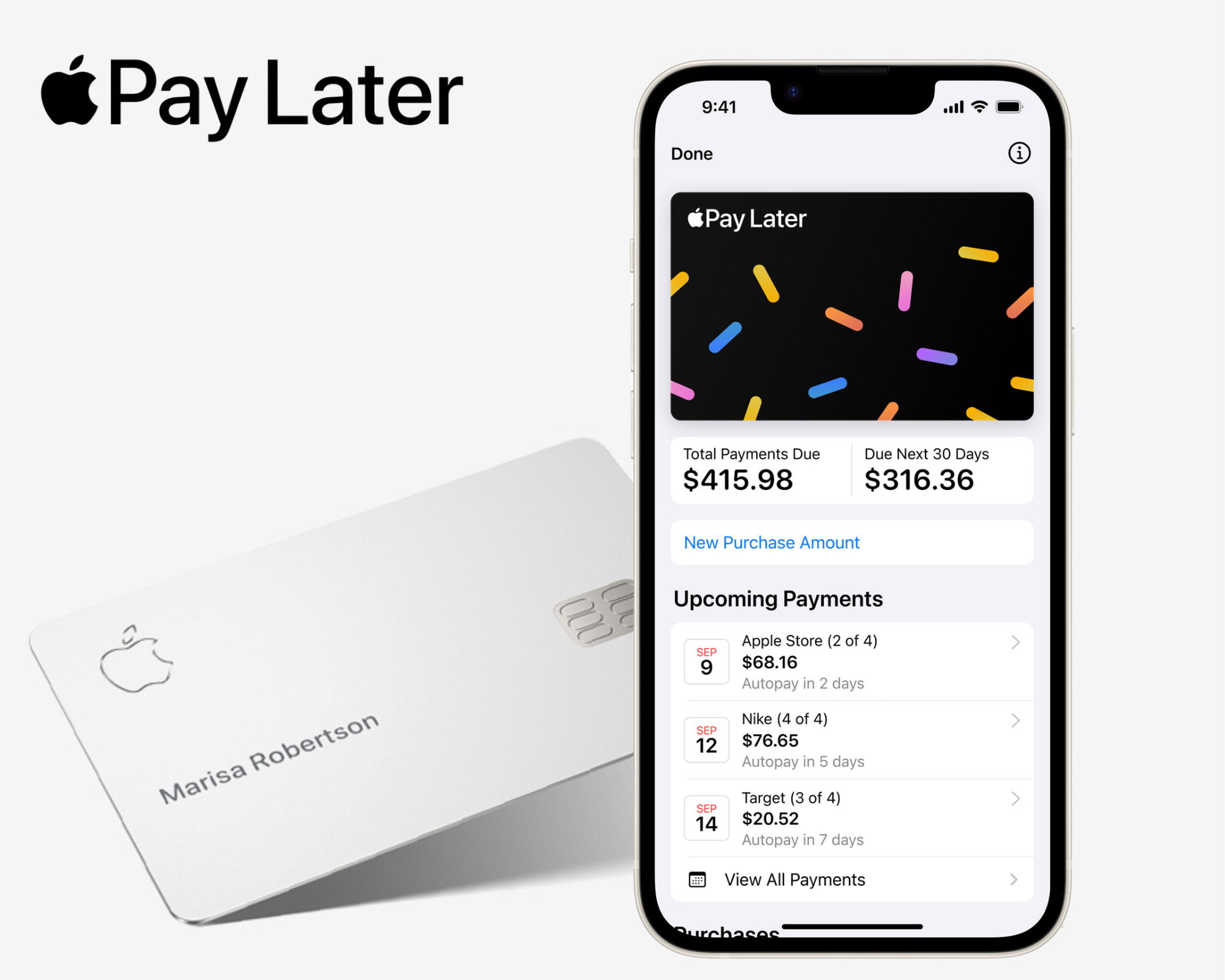

In a notable shift, Apple has introduced the discontinuation of its Apple Pay Later service, which allowed customers to pay for purchases in 4 installments over six weeks. Regardless of being absolutely launched within the U.S. in October 2023, the service will not settle for new loans, although current ones will stay unaffected. As a substitute, Apple is transitioning to providing installment loans by credit score and debit playing cards and third-party lenders.

Apple confirmed this alteration to 9to5Mac, emphasizing its dedication to offering safe and versatile fee choices. An organization assertion highlighted that this new world installment mortgage providing goals to carry versatile funds to extra customers worldwide in collaboration with banks and lenders supporting Apple Pay.

The service supplied interest-free loans starting from $50 to $1,000, manageable by Apple Pockets and reported to Experian, although to not different credit score bureaus. This pivot coincides with the upcoming iOS 18 launch, anticipated in September, which is able to embody built-in assist for third-party purchase now, pay later (BNPL) providers like Affirm.

Throughout Apple’s latest Worldwide Builders Convention (WWDC), the corporate highlighted partnerships with monetary giants similar to Citigroup and Synchrony Monetary, which is able to facilitate BNPL loans by Apple Pay. This strategic shift displays Apple’s plan to streamline its fee providers and develop its world attain.

This determination mirrors Apple’s efforts to stability innovation with practicality, making certain its providers stay user-friendly and accessible. Transferring away from a proprietary BNPL service to partnerships with established monetary entities suggests a strategic shift in direction of leveraging current monetary infrastructure to reinforce Apple Pay’s capabilities.

Whereas the discontinuation of Apple Pay Later might shock some, it highlights Apple’s adaptive method to evolving market dynamics. By collaborating with established monetary establishments and integrating third-party BNPL providers, Apple goals to offer a in depth and globally accessible fee resolution.

As Apple continues to refine its monetary providers, customers can count on improved performance and broader attain, reinforcing Apple Pay’s place as a frontrunner in safe, versatile fee options. This transition marks a necessary step in Apple’s journey towards making a seamless, built-in monetary ecosystem for its customers.

When you preferred this story, please observe us and subscribe to our free day by day publication.