Think about getting a name or message out of your speedy senior — or possibly even the pinnacle honcho of the entire firm. They warn you a few nasty state of affairs brewing. It spells fines or another monetary woes for the corporate, large bother on your division, and attainable dismissal for you personally! Chilly sweat trickles down your backbone, however there’s nonetheless an opportunity to save lots of the day! You’ll need to hustle and do just a few belongings you don’t often do, however every part must be alright…

First – maintain your horses and take just a few deep breaths. There’s a 99% probability this complete “emergency” is totally made up and the particular person on the road is a scammer. However how do you acknowledge such an assault and defend your self?

Anatomy of the assault

These schemes are available in dozens of flavors. Scammers could describe numerous points confronted by your organization relying on the actual nation, cite involvement of regulators, police, or main enterprise companions, after which counsel all method of the way to “clear up the issue” together with your assist. But there are a selection of key factors — essential psychological footholds — with out which the assault is subsequent to unattainable to hold out. These can be utilized to acknowledge the assault for what it’s.

- The superior’s authority, or easy belief in somebody you realize. Most individuals by now have developed a resistance to odd requests from strangers — be it a police officer who’s determined to succeed in out by prompt messaging, or a financial institution worker personally involved about your wellbeing. This scheme is totally different: the particular person approaching the sufferer seems to be somebody you realize to some extent — and a reasonably essential particular person at that. Scammers usually select a C-level supervisor’s profile as bait. First, they’ve authority; second, likelihood is the sufferer is aware of the particular person, however not properly sufficient to identify the inevitable variations in speech or writing model. Nonetheless, there are variations on this scheme the place the scammers impersonate a coworker from a related division (resembling accounting or authorized) whom chances are you’ll not know personally.

- Redirection to an exterior celebration. In probably the most primitive circumstances, the “coworker” or “supervisor” who reaches out to you can be the particular person you get a request about cash from. Most frequently although, after the preliminary contact, the “boss” suggests you focus on the small print of the matter with an exterior contractor who’s about to succeed in out. Relying on the scheme’s specifics, this “assigned particular person” could also be launched as a legislation enforcement or tax officer, financial institution worker, auditor or related; i.e., not somebody the sufferer is aware of. The “boss” will ask you to supply the “designated particular person” with all the help they’ll want and immediately. That mentioned, probably the most elaborate schemes, resembling the one with $25 million stolen following a deepfake video convention, could have the scammers pose as firm staff all through.

- A request must be pressing, in order to not give the sufferer time to cease and analyze the state of affairs. “The audit is tomorrow”, “the accomplice’s simply arrived”, “the quantity will get charged this afternoon”… lengthy story brief, you must act proper now. Scammers will usually conduct this a part of the dialog by telephone, telling the sufferer to not grasp up till the cash is transferred.

- Absolute secrecy. To forestall anybody from interfering with the fraud, the “boss” early on warns the sufferer that discussing the incident with anybody is strictly forbidden as disclosure would result in disastrous penalties. The fraudster may say that they’ve nobody else to belief, or that a number of the different staff are criminals or disloyal to the corporate. They are going to usually attempt to maintain the sufferer from speaking to anybody till their calls for are met.

Aims of the assault

Relying on the sufferer’s place and degree of earnings, an assault could pursue totally different objectives. If the sufferer is permitted by the corporate to execute monetary transactions, the scammers will attempt to discuss them into making an pressing secret fee to a vendor resembling a legislation agency for help in fixing issues — or simply transferring the corporate’s cash to a “secure” account.

Staff who don’t cope with the corporate’s cash could be focused by assaults that search to acquire firm information resembling passwords to inside programs, or their very own funds. Scammers could give you dozens of backstories, starting from an accounting information leak that jeopardizes the sufferer’s account, to a must maintain the corporate’s money hole closed till an audit is completed. Within the latter case, the sufferer is requested to make use of their very own cash indirectly: switch it to a different account, pay for present playing cards or vouchers, or withdraw it and provides it to a “trusted particular person”. For better persuasiveness, the scammers could promise the sufferer beneficiant compensation for his or her bills and energy — solely later.

Convincing degree of element

Social media posts and quite a few information leaks have made it a lot simpler for fraudsters to launch rigorously ready, personalised assaults. They will: discover the complete names of the sufferer, their speedy senior, the CEO, and staff within the related departments (resembling accounting), together with the precise division names; and discover footage of those people to create convincing prompt messaging profiles and, if wanted, even voice samples to create audio deepfakes. If there’s large cash at stake, the scammers could make investments vital time in making the charade as convincing as could be. In some earlier circumstances, attackers even knew the places of firm departments inside buildings and the positions of particular person staff’ desks.

Technical aspect of the assault

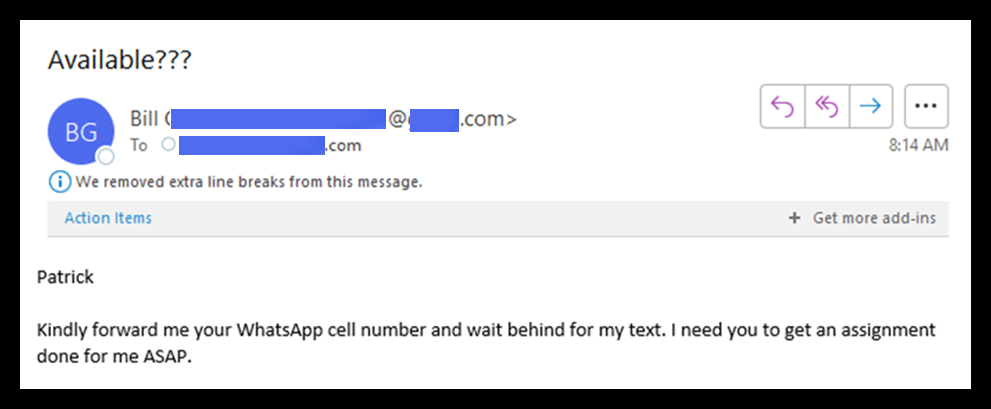

Subtle schemes like this practically all the time embrace a telephone name from the scammers; nonetheless, the preliminary “name from the boss” may come within the type of an e mail or prompt message. In easier variations of the assault, the scammers simply create a brand new prompt messaging or e mail account with the supervisor’s identify, whereas in additional subtle circumstances they hack their company e mail or private accounts. That is known as a BEC (enterprise e mail compromise) assault.

As for telephone calls, scammers usually use quantity spoofing companies or receive an unlawful copy of the SIM card — the sufferer’s caller ID then shows the corporate’s normal telephone quantity and even their boss’s personal.

Malicious actors could use deepfake voice turbines, so a well-recognized voice on the opposite finish of the road can’t assure the caller’s authenticity. Schemes like these could even use video calling the place the caller’s face can be a deepfake.

Defending your self towards scammers

Firstly, attentiveness and braveness to confirm the data regardless of the scammers’ threats are two issues that may defend you towards this type of assault.

Take it gradual, and don’t panic. The scammers intention to knock you off stability. Hold calm and double-check all of the details. Even when the opposite celebration insists you don’t grasp up the telephone, you possibly can all the time fake that the decision dropped. This may purchase you a while to do extra fact-checking.

Take note of the sender’s deal with, telephone, and consumer identify. Should you’re used to corresponding together with your boss by e mail, however then you definitely abruptly get an prompt message of their identify from an unfamiliar quantity, it’s time to prick up your ears. Should you’ve all the time talked on an prompt messaging app and also you get a brand new message however there’s no historical past, this implies somebody’s utilizing a newly created account, which is a serious crimson flag. Sadly, cybercriminals generally use pretend e mail addresses which can be exhausting to inform from the actual ones, or hacked e mail or prompt messaging accounts. All of this makes detecting forgery rather more tough.

Take note of small particulars. If an individual you realize approaches you with an odd request, is there something concerning the state of affairs that tells you that the particular person could also be an impostor? Do their emails look barely uncommon? Are they utilizing uncharacteristic figures of speech? Do you often deal with one another by first names, however they’re utilizing a proper type of deal with? Attempt asking them one thing solely the actual particular person may know.

Increase a crimson flag if you happen to get an uncommon request. In case your boss or coworker is urgently asking you to do one thing uncommon — and to maintain it a secret as well — that is practically all the time an indication of a rip-off. Subsequently, it’s vital that you just confirm the data you get and affirm the opposite celebration’s id. The least you are able to do is contact that particular person utilizing a special channel of communication. Speaking in particular person is greatest, but when this isn’t a risk, name their workplace or residence quantity that you just’ve bought down in your telephone e-book, or punch in that quantity manually; don’t simply dial the final incoming quantity — to keep away from circling again to the scammers. Use some other channels of communication out there. The cell quantity that known as you — even when it’s your boss or coworker’s actual quantity you’ve gotten saved in your telephone e-book — might need been compromised by SIM swapping or easy telephone theft.

Examine together with your coworkers. Regardless of being requested to “maintain all of it confidential”, relying on the character of the request, it doesn’t damage to confirm the data together with your coworkers. Should you get what seems to be a message from somebody in accounting, contact different individuals in the identical division.

Warn your coworkers and legislation enforcement. Should you obtain such a message, it means scammers are focusing on your group and coworkers. If their methods don’t work on you, they’ll attempt the subsequent division. Warn your coworkers, warn safety, and report the tried rip-off to the police.